SHANGHAI, China, Aug. 16, 2023 (GLOBE NEWSWIRE) — Intchains Group Limited (Nasdaq: ICG) (“we,” or the “Company”), a provider of integrated solutions consisting of high-performance computing ASIC chips and ancillary software and hardware for blockchain applications, today announced its unaudited financial results for the second quarter ended June 30, 2023.

Second Quarter 2023 Operating and Financial Highlights

- Sales volume of ASIC chips was 371,423 units for the second quarter of 2023, representing a decrease of 65.3% from 1,071,845 units for the same period of 2022.

- Revenue was RMB13.9 million (US$1.9 million) for the second quarter of 2023, representing a decrease of 91.3% from RMB159.4 million for the same period of 2022.

- Net loss was RMB20.5 million (US$2.8 million) for the second quarter of 2023, compared with a net income of RMB117.6 million for the same period of 2022.

Mr. Qiang Ding, Chairman of the Board of Directors and Chief Executive Officer, commented, “In the second quarter of 2023, the blockchain industry began a gradual recovery. Continued expansion of the technology’s application scenarios demonstrated its sustainable growth potential, which further bolstered investor confidence. Simultaneously, the ongoing evolution of blockchain technology unlocked vast new opportunities across a multitude of industries. As a fast-growing company and provider of high-performance computing ASIC chips and related software and hardware, our goal is to build Intchains into a leading Web 3.0 infrastructure provider. To progress to the next stage of this journey, we have been proactively exploring downstream growth opportunities to accelerate our product offering expansion beyond ASIC chips. Moving forward, we will continue to innovate and iterate advanced hardware and software for Web 3.0 application scenarios as we broaden our services throughout the industry value chain and promote the healthy and sustainable development of the Web 3.0 industry as a whole.”

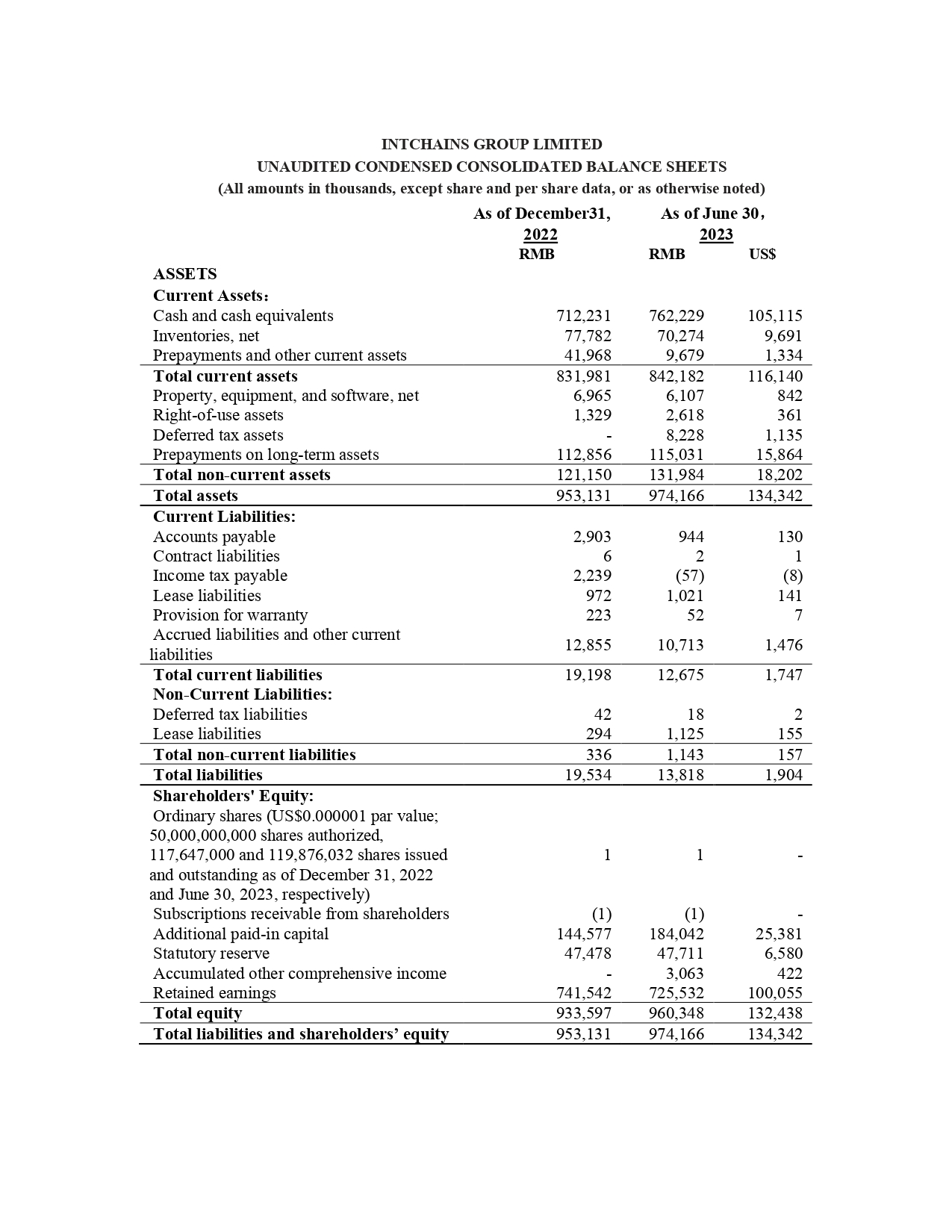

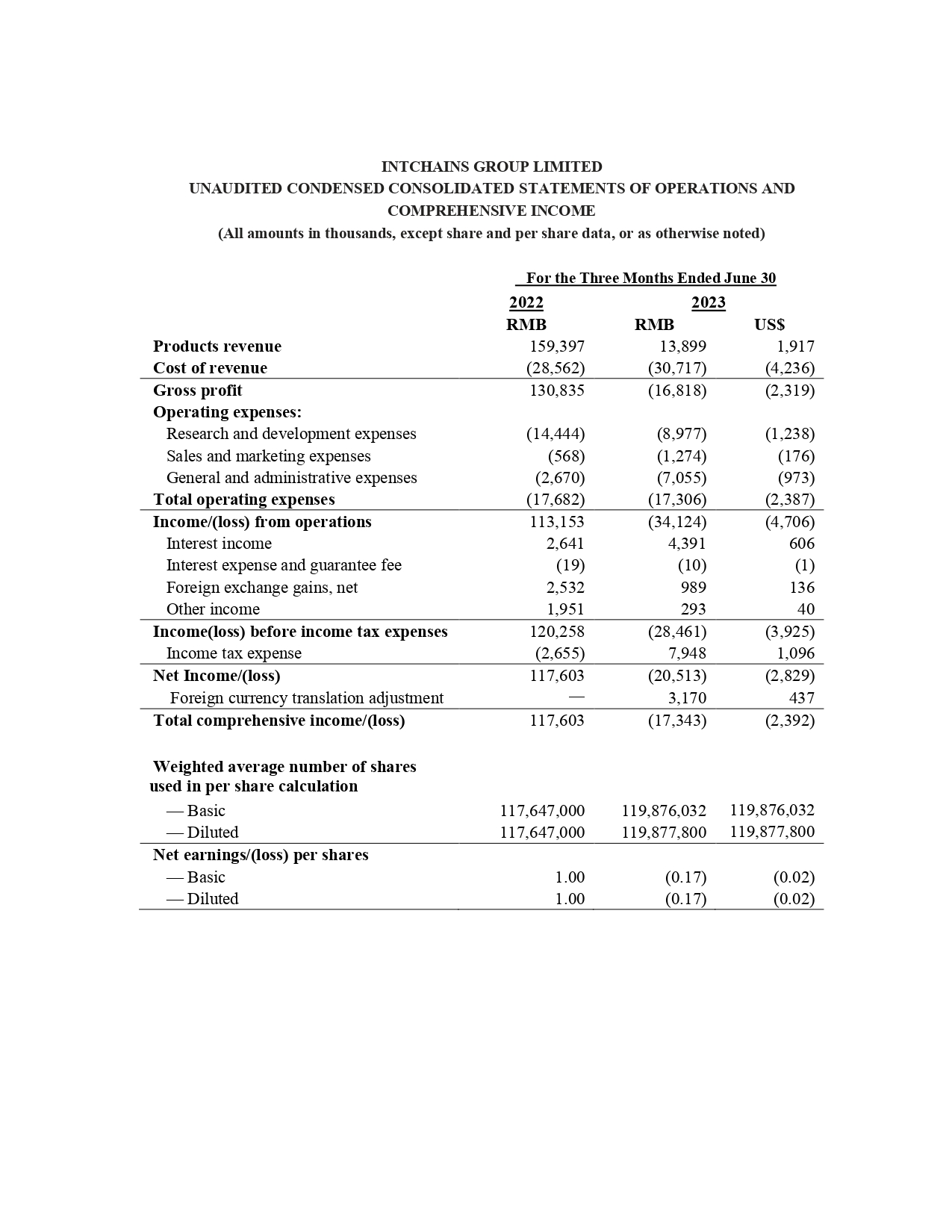

Second Quarter 2023 Financial Results

Revenue

Revenue was RMB13.9 million (US$1.9 million) for the second quarter of 2023, representing a decrease of 91.3% from RMB159.4 million for the same period of 2022. The decrease was mainly due to the challenging cryptocurrency market despite recent signs of recovery, which resulted in decreases in the sales volume and average selling price of our ASIC chips that were primarily used in cryptocurrency mining machines.

Cost of Revenue

Cost of revenue was RMB30.7 million (US$4.2 million) for the second quarter of 2023, representing an increase of 7.5% from RMB28.6 million for the same period of 2022. The increase was mainly attributable to an inventory write-down of RMB22.5 million, partially offset by the decrease in sales volume of our ASIC chips.

Operating Expenses

Total operating expenses were RMB17.3 million (US$2.4 million) for the second quarter of 2023, representing a decrease of 2.1% from RMB17.7 million for the same period of 2022. This decrease was primarily due to the decrease in research and development expenses, partially offset by the increases in sales and marketing expenses and general and administrative expenses.

- Research and development expenses decreased by 37.8% to RMB9.0 million (US$1.2 million) for the second quarter of 2023 from RMB14.4 million for the same period of 2022. The decrease was primarily attributable to the different stages our research and development projects were in during the respective periods.

- Sales and marketing expenses increased by 124.3% to RMB1.3 million (US$0.2 million) for the second quarter of 2023 from RMB0.6 million for the same period of 2022, mainly due to an increase in personnel-related expenses.

- General and administrative expenses increased by 164.2% to RMB7.1 million (US$1.0 million) for the second quarter of 2023 from RMB2.7 million for the same period of 2022, primarily due to an increase in labor cost and professional expenses, partially offset by a decrease in tax surcharges.

Interest Income

Interest income increased by 66.3% to RMB4.4 million (US$0.6 million) for the second quarter of 2023 from RMB2.6 million for the same period of 2022, mainly attributable to the increase in our cash balance, which is a result of our effective fund management and the proceeds generated from our initial public offering.

Other Income

Our other income decreased by 85.0% to RMB0.3 million (US$0.04 million) for the second quarter of 2023 from RMB2.0 million for the same period of 2022. The decrease was primarily due to a decrease in grants we received from local government. The government grants were granted to us to support qualified IC industry projects with no repayment obligations.

Net Loss

As a result of the foregoing, we recorded a net loss of RMB20.5 million (US$2.8 million) for the second quarter of 2023, compared with a net income of RMB117.6 million for the same period of 2022.

Basic and Diluted Net Loss Per Ordinary Share

Basic and diluted net loss per ordinary share were RMB0.17 (US$0.02) for the second quarter of 2023, compared with basic and diluted net earnings per ordinary share of RMB1.00 for the same period of 2022. Each ADS represents two of the Company’s Class A ordinary shares.

Recent Developments

In June 2023, the Company entered into an agreement to acquire an office building for approximately RMB44.5 million. This building is located in Shanghai’s Lingang New Area, Pilot Free Trade Zone and will serve as the Company’s R&D headquarter. We believe this well-equipped and advanced R&D facility will not only facilitate the continued iteration of our existing products and the development of our new generation of ASIC chips, but also enhance the Company’s market competitiveness in the long run. All funds for this purchase will come from the Company’s balance sheet and will not affect our normal operations.

Conference Call Information

The Company’s management team will host an earnings conference call to discuss its financial results at 9:00 P.M. U.S. Eastern Time on August 16, 2023 (9:00 A.M. Beijing Time August 17, 2023). Details for the conference call are as follows:

Event Title:

Date:

Time:

Registration Link:

Intchains Group Limited Second Quarter 2023 Earnings Conference Call

August 16, 2023

9:00 P.M. U.S. Eastern Time

https://register.vevent.com/register/BI41e89d9be4de44169f6ccdb152a02fe8

All participants must use the link provided above to complete the online registration process in advance of the conference call. Upon registering. each participant will receive a set of dial-in numbers and a personal access PIN, which will be used to join the conference call.

Additionally, a live and archived webcast of the conference call will also be available at the Company’s website at: https://intchains.com/.

About Intchains Group Limited

Intchains Group Limited is a provider of integrated solutions consisting of high-performance ASIC chips and ancillary software and hardware for blockchain applications. The Company utilizes a fabless business model and specializes in the front-end and back-end of IC design, which are the major components of the IC product development chain. The Company has established strong supply chain management with a leading foundry, which helps to ensure its product quality and stable production output. The Company’s products consist of high-performance ASIC chips that have high computing power and superior power efficiency as well as ancillary software and hardware, which cater to the evolving needs of the blockchain industry. The Company has built a proprietary technology platform named “Xihe” platform, which allows the Company to develop a wide range of ASIC chips with high efficiency and scalability. For more information, please visit the Company’s website at: https://intchains.com/.

Exchange Rate Information

The unaudited United States dollar (“US$”) amounts disclosed in the accompanying financial statements are presented solely for the convenience of the readers. Translations of amounts from RMB into US$ for the convenience of the reader were calculated at the noon buying rate of US$1.00=RMB7.2513 on the last trading day of the second quarter (June 30, 2023). No representation is made that the RMB amounts could have been, or could be, converted into US$ at such rate.

Forward Looking Statements

Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Forward-looking statements include, but are not limited to, statements about: (i) our goals and strategies; (ii) our future business development, formed condition and results of operations; (iii) expected changes in our revenue, costs or expenditures; (iv) growth of and competition trends in our industry; (v) our expectations regarding demand for, and market acceptance of, our products; (vi) general economic and business conditions in the markets in which we operate; (vii) relevant government policies and regulations relating to our business and industry; and (viii) assumptions underlying or related to any of the foregoing. Investors can identify these forward-looking statements by words or phrases such as “may,” “could,” “will,” “should,” “would,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “project” or “continue” or the negative of these terms or other comparable terminology. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s registration statement and other filings with the SEC.

For investor and media inquiries, please contact:

Intchains Group Limited

Investor relations

Email: [email protected]

Piacente Financial Communications

In China

Helen Wu

Tel: +86-10-6508-0677

Email: [email protected]

In The United States

Brandi Piacente

Tel: +1-212-481-2050

Email: [email protected]

Discover more from Intchains Group

Subscribe to get the latest posts sent to your email.