SHANGHAI, China – May 16, 2024 – Intchains Group Limited (Nasdaq: ICG) (“we,” or the “Company”), a provider of integrated solutions consisting of high-performance computing ASIC chip-based solutions products and a corporate holder of cryptocurrencies based on Ethereum, or ETH, today announced its unaudited financial results for the first quarter ended March 31, 2024.

First Quarter 2024 Operating and Financial Highlights

- Sales volume of ASIC chips remained steady at 494,235 units for the first quarter of 2024, compared to 497,854 units for the same period of 2023. ASIC chip sales for the first quarter of 2024 consisted of 410,162 units sold directly to customers and 84,073 units embedded in computing equipment for blockchain applications that we began offering to customers in the fourth quarter of 2023.

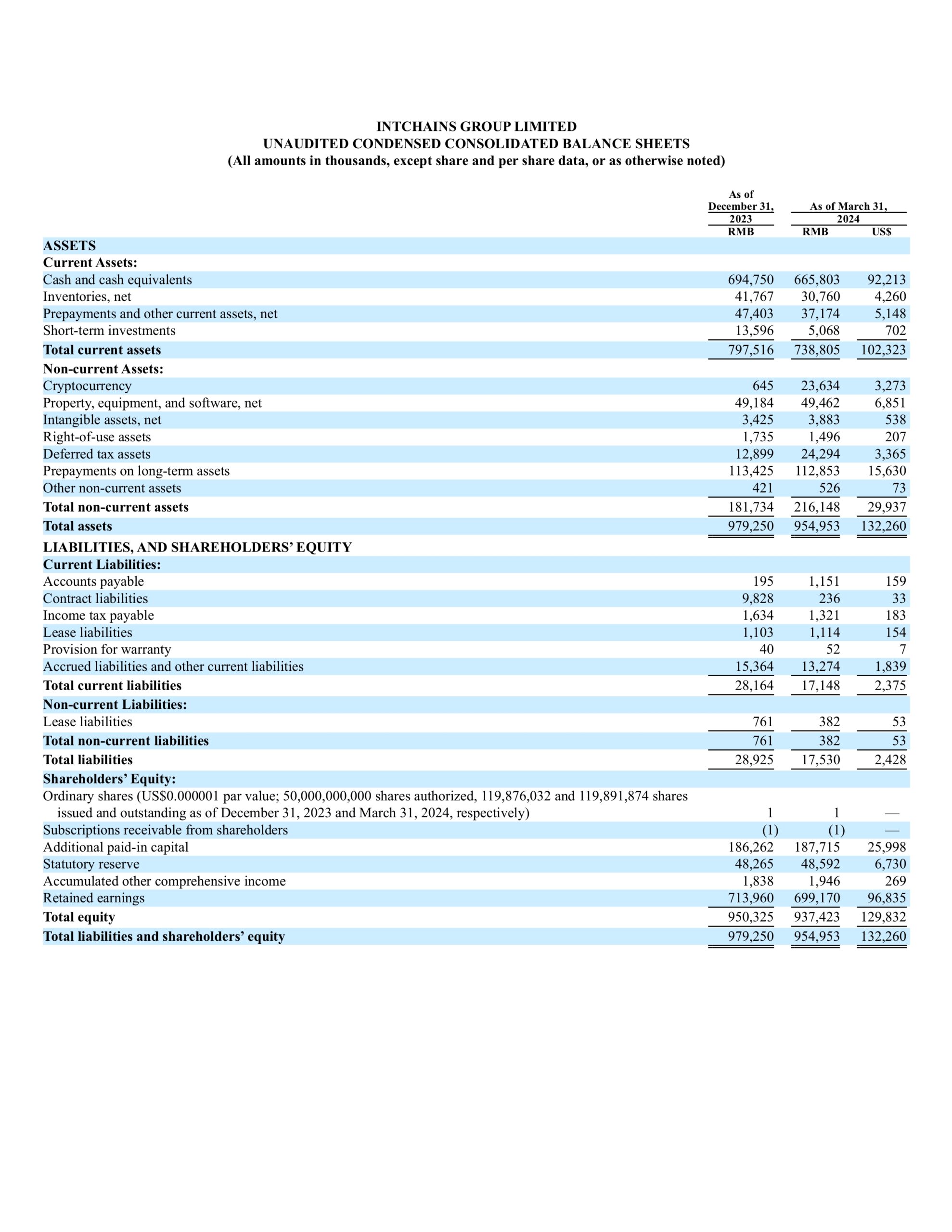

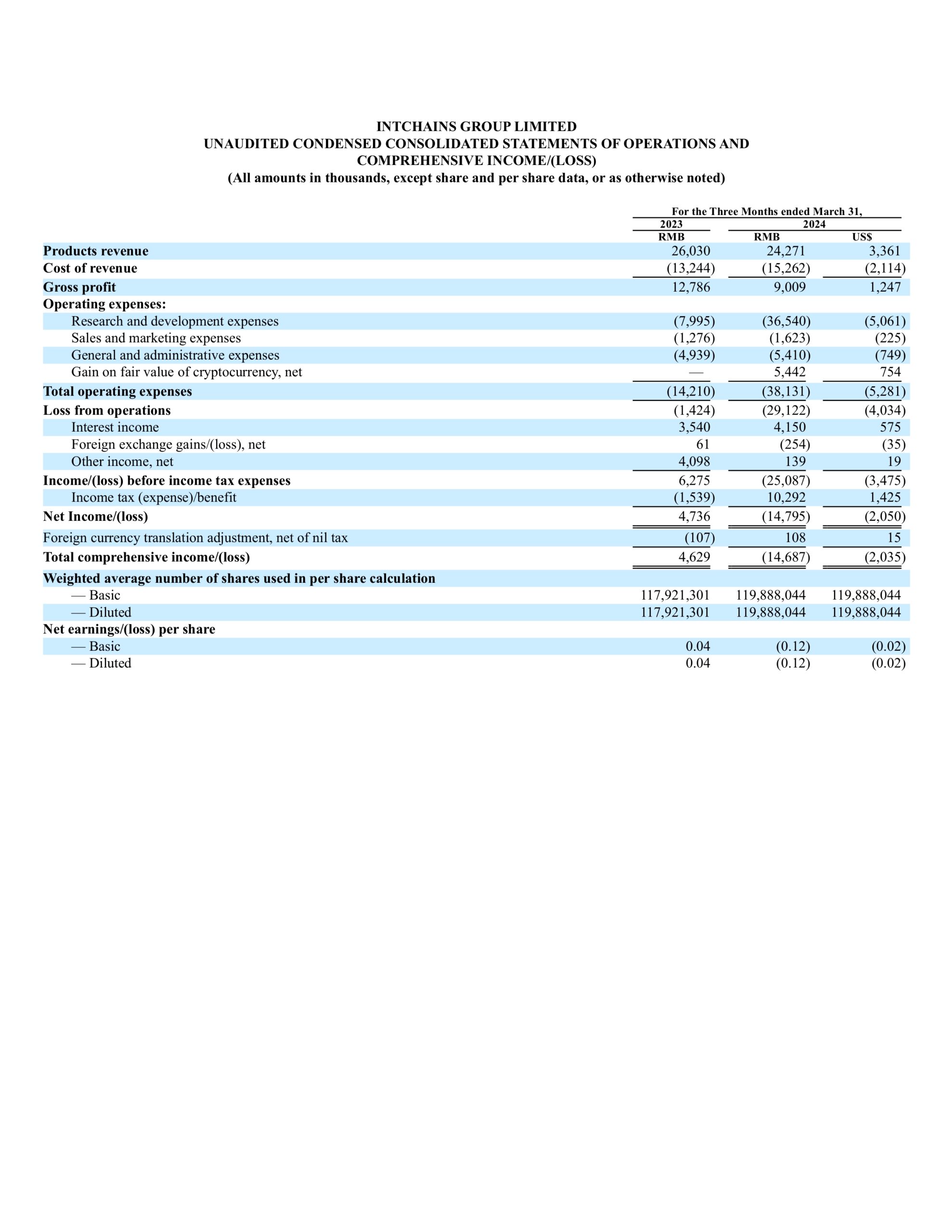

- Revenue was RMB24.3 million (US$3.4 million) for the first quarter of 2024, representing a decrease of 6.8% from RMB26.0 million for the same period of 2023.

- Net loss was RMB14.8 million (US$2.1 million) for the first quarter of 2024, compared to net income of RMB4.7 million for the same period of 2023.

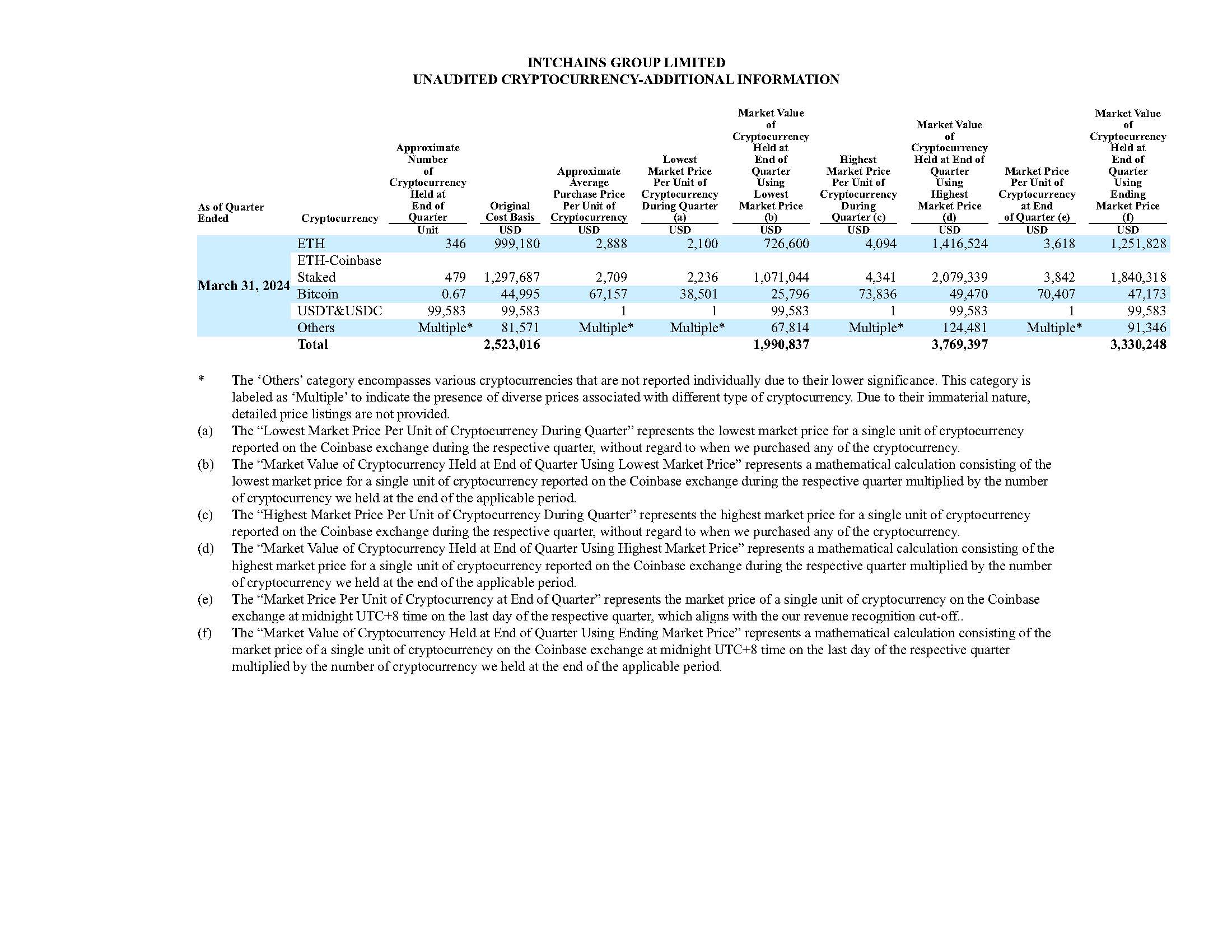

- As of March 31, 2024, the fair value of our cryptocurrency assets was RMB23.6 million (US$3.3 million), primarily comprised of approximately 825 ETH, with a total fair value of RMB21.9 million (US$3.1 million).

Mr. Qiang Ding, Chairman of the Board of Directors and Chief Executive Officer, commented, “During the first quarter of 2024, the industry demonstrated a clear upward trajectory. As a market leader, Intchains fully leveraged its resources and technological advantages to seize rising opportunities within the industry and along the value chain. While we remain committed to fostering growth and progress across our current business lines, we are actively exploring new products and business models. In the first quarter of 2024, we began trial production and sales of our newly introduced Goldshell-branded Box series computing equipment for blockchain applications. These devices feature the latest ASIC chips, designed and manufactured using a 12nm process node, which swiftly garnered widespread market acclaim and bolstered recognition of our cutting-edge technology and brand. As we progress through 2024, we will continue to enhance our R&D capabilities and develop additional ASIC chip products tailored for applications across the WEB3 industry.

Mr. Ding added, “We have begun implementing a pivotal cryptocurrency acquisition strategy in this quarter to expand our investment in cryptocurrencies with ETH-based cryptocurrencies serving as our primary long-term asset reserve. We believe that this initiative will fully unlock the value of our capital, while enhancing Intchains’ competitiveness and our role in the development of the WEB3 industry, propelling sustainable growth for both the Company and the industry.”First Quarter 2024 Financial Results

Revenue

Cost of Revenue

Operating Expenses

Total operating expenses were RMB38.1 million (US$5.3 million) for the first quarter of 2024, representing an increase of 168.3% from RMB14.2 million for the same period of 2023. The increase was primarily due to an increase in research and development expenses, sales and marketing expenses, and general and administrative expenses, partially offset by a net gain on fair value of cryptocurrency.

- Research and development expenses increased by 357.0% to RMB36.5 million (US$5.1 million) for the first quarter of 2024 from RMB8.0 million for the same period of 2023. The increase was primarily due to higher expenses related to mask costs for our research and development projects, as well as increased personnel-related expenses.

- Sales and marketing expenses increased by 27.2% to RMB1.6 million (US$0.2 million) for the first quarter of 2024 from RMB1.3 million for the same period of 2023, mainly driven by increased share-based incentive expenses.

- General and administrative expenses increased by 9.5% to RMB5.4 million (US$0.7 million) for the first quarter of 2024 from RMB4.9 million for the same period of 2023, mainly driven by increased share-based incentive expenses.

- Gain on fair value of cryptocurrency, net, for the first quarter of 2024 was RMB5.4 million (US$0.7 million), compared to nil in the same period of 2023. We early-adopted the amendments required pursuant to ASU 2023-08 on January 1, 2024, using a modified retrospective transition method with a cumulative-effect adjustment recorded to the opening balance of retained earnings as of January 1, 2024. The cumulative-effect adjustment of RMB0.3 million was recorded as an increase to the opening balance of retained earnings as of January 1, 2024. We measured cryptocurrency at fair value and included the gains and losses from remeasurement in net income. The gain pertains to the change in cryptocurrency’s fair value from the adoption date, January 1, 2024, to March 31, 2024, which was mainly due to the increased price of ETH.

Interest Income

Other Income, Net

Net Income/(Loss)

Basic and Diluted Net Earnings/(Loss) Per Ordinary Share

Recent Developments

We have begun implementing a pivotal cryptocurrency acquisition strategy in this quarter to expand the Company’s investments in cryptocurrencies. Pursuant to this strategy, the Company plans to acquire ETH-based cryptocurrencies using cash flows generated from operations. We view our holdings of ETH-based cryptocurrencies as long-term holdings and expect to continue to accumulate ETH-based cryptocurrencies. We have not set any specific target for the amount of ETH-based cryptocurrencies we seek to hold, and we will continue to monitor market conditions in determining whether to purchase additional ETH-based cryptocurrencies. Going forward, ETH-based cryptocurrencies will serve as a crucial long-term asset reserve for us.

Conference Call Information

Event Title:

Date:

Time:

Registration Link:

Intchains Group Limited First Quarter 2024

Earnings Conference Call

May 16, 2024

9:00 P.M. U.S. Eastern Time

https://register.vevent.com/register/BI6390b60244b94f14ae203c00c53a2f4e

All participants must use the link provided above to complete the online registration process in advance of the conference call. Upon registering, each participant will receive a set of dial-in numbers and a personal access PIN, which will be used to join the conference call.

Additionally, a live and archived webcast of the conference call will also be available at the Company’s website at: https://intchains.com/.

About Intchains Group Limited

Exchange Rate Information

Forward Looking Statements

For investor and media inquiries, please contact:

Intchains Group Limited

Investor relations

Email: [email protected]

Piacente Financial Communications

In China

Helen Wu

Tel: +86-10-6508-0677

Email: [email protected]

In The United States

Brandi Piacente

Tel: +1-212-481-2050

Email: [email protected]

Discover more from Intchains Group

Subscribe to get the latest posts sent to your email.