Loading Inline Form.

Table of Contents

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

N/A |

* |

Large accelerated filer |

☐ | Accelerated filer |

☐ | ☒ | Emerging growth company |

International Financial Reporting Standards as issued by the International Accounting Standards Board |

Other |

Table of Contents

TABLE OF CONTENTS

i

Table of Contents

INTRODUCTION

Except where the context otherwise requires and for purposes of this annual report only:

| • | unless otherwise noted, all references to years are to the calendar years from January 1 to December 31 and references to our fiscal year or years are to the fiscal year or years ended December 31. |

| • | “ADRs” refers to the American depositary receipts, which, if issued, evidence our ADSs. |

| • | “ADSs” refers to our American depositary shares, each of which represents two Class A ordinary shares. |

| • | “ASICs” refers to application-specific ICs, meaning ICs designed for a specific application. |

| • | “CAGR” refers to compound average growth rate. |

| • | “China” or the “PRC”, in each case, refers to the People’s Republic of China, including Hong Kong, Macau and Taiwan. The term “Chinese” has a correlative meaning for the purpose of this annual report. When used in the case of laws and regulations, of “China” or “the PRC”, it refers to only such laws and regulations of mainland China all references to “Renminbi” or “RMB” are to the legal currency of mainland China, and all references to “U.S. dollars,” “dollars,” “$” or “US$” are to the legal currency of the United States. |

| • | “Class A ordinary shares” refers to our class A ordinary shares, par value US$0.000001 per share. |

| • | “Class B ordinary shares” refers to our class B ordinary shares, par value US$0.000001 per share. |

| • | “Company” refers to Intchains Group Limited, a Cayman Islands company and its subsidiaries. |

| • | “EIT” refers to enterprise income tax. |

| • | “IC” or “chips” refers to integrated circuits. |

| • | “IoT” refers to Internet-of-Things, the extension of internet connectivity into physical devices and everyday objects. |

| • | “iterate” or “iteration” refers to the act of repeating a process, either to generate an unbounded sequence of outcomes, or with the aim of approaching a desired goal, target or result. |

| • | “mainland China” refers to the People’s Republic of China, excluding, solely for the purpose of this annual report, Hong Kong, Macau and Taiwan. The term “mainland Chinese” has a correlative meaning for the purpose of this report. |

| • | “PRC law(s) and regulation(s)” refers to the laws and regulations of mainland China. |

| • | “nm” refers to nanometer. |

| • | “ordinary shares” or “shares” refer to our Class A ordinary shares and Class B ordinary shares. |

| • | “PoW” refers to proof-of-work. |

| • | “Risc-V” refers to an open source instruction set architecture, which is a set of instructions that describes the way in which software talks to an underlying processor, and Risc-V’s open source nature means that anyone can build a processor to support it without paying high royalty fees. |

| • | “RMB” and “Renminbi” refer to the legal currency of mainland China. |

| • | “SoC” refers to a chip that integrates all components of a computer or other electronic systems. |

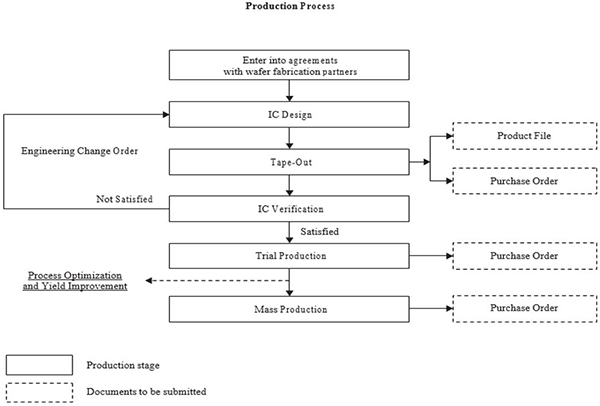

| • | “tape-out” refers to the final result of the design process for ICs when the graphic for the photomask of the IC is sent to the fabrication facility, and a successful tape-out means all the stages in the design and verification process of ICs have been completed. |

| • | “US$” and “U.S. dollars” refer to the legal currency of the United States. |

| • | “U.S. GAAP” refers to generally accepted accounting principles in the United States. |

| • | “we,” “us,” “our company,” “the Group,” and “our” refer to the Company and its subsidiaries, as the context requires. |

1

Table of Contents

This annual report includes our audited consolidated financial statements for the years ended December 31, 2020, 2021 and 2022, and the related notes. Each ADS represents two class A ordinary shares. Our ADSs are listed on the Nasdaq Capital Market, or Nasdaq, under the symbol “ICG”.

We conduct our business primarily in China and the majority of our revenues and expenses are denominated in Renminbi. The conversion of Renminbi into U.S. dollars in this annual report is based on the noon buying rate in the City of New York for cable transfers of Renminbi per U.S. dollars certified for customs purposes by the Federal Reserve Bank of New York, as set forth in the H.10 weekly statistical release of the Federal Reserve Board. Unless otherwise noted, all translations from Renminbi to U.S. dollars in this annual report are made at a rate of RMB6.8972 to US$1.00, the noon buying rate in effect as of December 31, 2022. We make no representation that any Renminbi or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or Renminbi, as the case may be, at any particular rate, or at all.

FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F contains forward-looking statements that are based on our current expectations, assumptions, estimates and projections about us and our industry. All statements other than statements of historical facts in this annual report are forward-looking statements. In some cases, these forward-looking statements can be identified by words and phrases such as “may,” “should,” “intend,” “predict,” “potential,” “continue,” “will,” “expect,” “anticipate,” “estimate,” “plan,” “believe,” “is /are likely to” or the negative form of these words and phrases or other comparable expressions. The forward-looking statements included in this annual report relate to, among others:

| • | our goals and strategies; |

| • | our future prospects and market acceptance of our products and services; |

| • | our future business development, financial condition and results of operations; |

| • | expected changes in our revenue, costs or expenditures; |

| • | growth of and competition trends in our industry; |

| • | our expectations regarding demand for, and market acceptance of, our products; |

| • | general economic and business conditions in the markets in which we operate; |

| • | relevant government policies and regulations relating to our business and industry; |

| • | PRC laws, regulations and policies, including those applicable to the IC industry and foreign exchange; |

| • | the impact of the political tensions between the United States and China or other countries, and the impact of actual or potential international military actions; |

| • | the impact of the outbreak and continuing spread of the coronavirus disease, or COVID-19, and other pandemics or natural disasters; and |

| • | assumptions underlying or related to any of the foregoing. |

These forward-looking statements involve various risks, assumptions and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are reasonable, our expectations may turn out to be incorrect. Our actual results could be materially different from our expectations. Important risks and factors that could cause our actual results to be materially different from our expectations are generally set forth in “Item 3. Key Information—D. Risk Factors” and elsewhere in this annual report.

The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. All forward-looking statements included herein attributable to us or other parties or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section and under the heading “Risk Factors” below. Except to the extent required by applicable laws and regulations, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events.

2

Table of Contents

PART I.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

Overview

We are a provider of integrated solutions consisting of high-performance computing ASIC chips and ancillary software and hardware for blockchain applications. We have a fabless business model and specialize in the front-end and back-end of IC design, which are the major components of the IC product development chain. We have strong supply chain management through our well-established business partnership with a leading foundry, which helps to ensure our product quality and stable production output.

Our products consist of high-performance computing ASIC chips that have high computing power and superior power efficiency as well as ancillary software and hardware, which cater to the evolving needs of the blockchain industry. We have built a proprietary technology platform named “Xihe” Platform, which allows us to develop a wide range of ASIC chips with high efficiency and scalability. We design our ASIC chips in-house, which enables us to leverage proprietary silicon data to deliver products reflecting the latest technological developments ahead of our competitors. As of December 31, 2022, we had completed a total of eight tape-outs using our “Xihe” Platform for 22nm ASIC chips, achieving a 100% success rate for all our tape-outs.

Our strong commitment to advanced research and development enables us to innovate continuously and create ASIC chips with superior performance to power ratio at reasonable cost. We will continue to devote significant resources to design and tailor our ASIC chips for use in high technology applications. Our total revenue increased significantly from RMB54.6 million in 2020 to RMB631.8 million in 2021 and decreased to RMB473.7 million (US$68.7 million) in 2022. At the same time, our proportion of R&D expenses to revenue is 41.2%, 8.4% and 10.2% respectively.

We operate business primarily in China and are subject to complex and evolving PRC laws and regulations. Uncertainties in the PRC legal system and the interpretation and enforcement of PRC laws and regulations could limit the legal protection available to you and us, hinder our ability to offer our ADSs in the future, result in a material adverse effect on our business operations, and damage our reputation, which might further cause our ADSs to significantly decline in value or become worthless. See “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business in the PRC.”

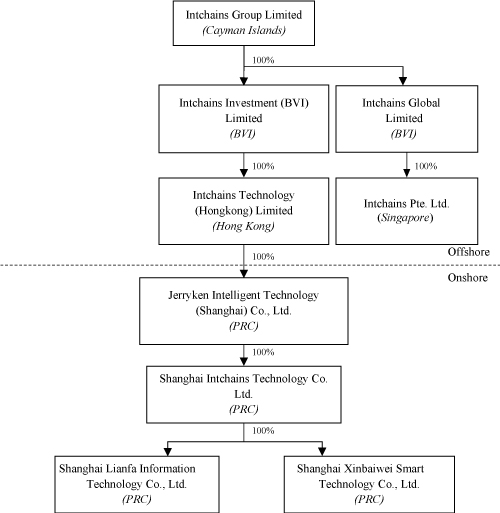

Our Corporate Structure

We are not a Chinese operating company but a Cayman Islands holding company with operations conducted through our subsidiaries based in China. The “Company” and “our Company” refer to Intchains Group Limited, a Cayman Islands company. “We,” “us,” and “our” refer to Intchains Group Limited and its subsidiaries. We currently conduct our business through Jerryken Intelligent Technology (Shanghai) Co., Ltd., or Jerryken Shanghai, and Shanghai Intchains Technology Co., Ltd., or Shanghai Intchains, each an indirect wholly owned subsidiary of the Company, and two operating subsidiaries wholly owned by Shanghai Intchains. All of these four operating subsidiaries are established under the laws of the PRC.

Intchains Group Limited holds all of the equity interests in its PRC subsidiaries through subsidiaries incorporated in the British Virgin Islands, or BVI, and Hong Kong. As we have a direct equity ownership structure, we do not have any agreement or contract between our Company and any of its subsidiaries that are typically seen in a variable interest entity structure. Within our direct equity ownership structure, funds from foreign investors can be directly transferred to our PRC subsidiaries by way of capital injection or in the form of a shareholder loan from Intchains Group Limited. If the Company plans to distribute dividends to its shareholders, our PRC operating subsidiaries will transfer the funds to the Company through our subsidiaries incorporated in the BVI and Hong Kong, and the Company will then distribute dividends to all shareholders in proportion to the shares they hold, regardless of the citizenship or domicile of the shareholders.

3

Table of Contents

The following diagram illustrates our simplified corporate structure as of the date of this annual report:

Government Regulations and Permissions

We have been advised by Jingtian & Gongcheng, our PRC legal adviser, that, as of the date of this annual report, we have obtained all necessary permissions, approvals and authorizations in mainland China in all material aspects in relation to conducting our IC design business operations in mainland China. Except for the business licenses issued by the local branch of the State Administration for Market Regulation, which our PRC subsidiaries have obtained and are in full force and effect as of the date of this annual report, Intchains Group Limited and our PRC subsidiaries are not required to obtain other licenses, approvals or permits to conduct our IC design business operations in mainland China. However, as PRC laws and regulations with respect to certain licenses and permissions are unclear and are subject to interpretations and enforcement of local governmental authorities, we may inadvertently conclude that certain permissions and approvals are not required but the regulators do not take the same view as we do. Also, if applicable laws, regulations or interpretations change, we may be required to obtain additional licenses or approvals. Moreover, there may be new rules, regulations, government interpretations or government policies in China to govern the businesses we currently operate. Such new rules, regulations, government interpretations or government policies may subject our business operations to additional license or filing requirements.

Cash Flow and Assets Transfer within Our Organization

4

Table of Contents

Intchains Group Limited is a Cayman Islands holding company with no material operations of its own. We conduct our operations through our PRC subsidiaries. As a result, although other means are available for us to obtain financing at the holding company level, the ability of Intchains Group Limited to pay dividends to the shareholders and to service any debt it may incur may depend upon dividends primarily paid by our PRC subsidiaries. If any of our PRC subsidiaries incurs debt on its own behalf, the instruments governing such debt may restrict its ability to pay dividends to Intchains Group Limited. In addition, under PRC laws and regulations, our PRC subsidiaries are permitted to pay dividends to Intchains Group Limited only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. Further, our PRC subsidiaries are required to make appropriations to certain statutory reserve funds or may make appropriations to certain discretionary funds, which are not distributable as cash dividends except in the event of a solvent liquidation of the PRC subsidiaries. For more details, see “Item 5. Operating and Financial Review and Prospects — B. Liquidity and Capital Resources—Holding Company Structure.”

Under PRC laws and regulations, our PRC subsidiaries are subject to certain restrictions with respect to paying dividends or otherwise transferring any of their net assets to us. Remittance of dividends by a wholly foreign-owned enterprise out of China is also subject to examination by the banks designated by State Administration of Foreign Exchange, or SAFE. For risks relating to the fund flows of our operations in China, see “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business in the PRC—Government control of foreign currency conversion may affect the value of your investment.”

We have never declared or paid any dividends on our ordinary shares since our inception, nor have any present plan to pay any dividends on our ordinary shares or ADSs in the foreseeable future. We currently intend to retain most, if not all, of our available funds and any future earnings to operate and expand our business. See “Item 8. Financial Information—A. Consolidated Statements and Other Financial Information—Dividend Policy.” For PRC and United States federal income tax considerations of an investment in our ADSs, see “Item 10. Additional Information—E. Taxation.”

Under PRC laws, Intchains Group Limited may fund our PRC subsidiaries by means of shareholders’ loans or capital contributions, subject to satisfaction of applicable government registration and approval requirements. For the three years ended December 31, 2020, 2021 and 2022, except for unsecured and interest-free inter-company funding of RMB11,040,000 transferred between our PRC subsidiaries in connection with our purchase of a 17.51% of equity interest in Shanghai Intchains Technology Co., Ltd and inter-company transactions that occurred in the ordinary course of business, no cash or other asset transfers occurred among Intchains Group Limited and its subsidiaries, and no dividends or distributions from a subsidiary were made to Intchains Group Limited or other investors.

Dividends or Distributions Made to the Company and Tax Consequences Thereof

Our subsidiaries did not make any dividends or distributions to us for years ended December 31, 2020, 2021 and 2022. If any dividend is paid by our PRC subsidiaries to the Company in the future, the Enterprise Income Tax Law and its implementation rules provide that a withholding tax at a rate of 10% will be applicable to dividends payable by Chinese companies to non-PRC-resident enterprises unless reduced under treaties or arrangements between the PRC central government and the governments of other countries or regions where the non-PRC resident enterprises are tax resident. Pursuant to the tax agreement between mainland China and the Hong Kong Special Administrative Region, the withholding tax rate in respect of the payment of dividends by a PRC enterprise to a Hong Kong enterprise may be reduced to 5% from a standard rate of 10%. However, if the relevant tax authorities determine that our transactions or arrangements are for the primary purpose of enjoying a favorable tax treatment, the relevant tax authorities may adjust the favorable withholding tax in the future. Accordingly, there is no assurance that the reduced 5% withholding rate will apply to dividends received by our Hong Kong subsidiary from our PRC subsidiaries. If the Company or its offshore subsidiaries are deemed to be a PRC resident enterprise (we do not currently consider the Company or its offshore subsidiaries to be PRC resident enterprises), the withholding tax may be exempted, but the Company or its offshore subsidiaries will be subject to a 25% tax on our worldwide income, and our non-PRC enterprise investors may be subject to PRC income tax withholding at a rate of 10%. See “—D. Risk Factors—Risks Relating to Regulations of Our Business—We may be classified as a “resident enterprise” for PRC enterprise income tax purposes, which could result in unfavorable tax consequences to us and our non-PRC shareholders.” and “Item 10. Additional Information—E. Taxation—People’s Republic of China Taxation.”

Dividends or Distributions Made to the U.S. Investors and Tax Consequences Thereof

We did not make any dividends or distributions to our shareholders for years ended December 31, 2020, 2021 and 2022. Any future determination to pay dividends will be made at the discretion of our board of directors and will be based upon our future operations and earnings, capital requirements and surplus, general financial condition, shareholders’ interests, contractual restrictions and other factors our board of directors may deem relevant.

5

Table of Contents

Under the current laws of the Cayman Islands, no Cayman Islands withholding tax is imposed upon any payments of dividends by the Company. However, if the Company is considered a PRC tax resident enterprise for tax purposes (we do not currently consider the Company to be a PRC resident enterprise), any dividends that the Company pays to its overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax. See “Item 3. Key Information—D. Risk Factors—Risks Relating to Regulations of Our Business—We may be classified as a “resident enterprise” for PRC enterprise income tax purposes, which could result in unfavorable tax consequences to us and our non-PRC shareholders” and “Item 10. Additional Information—E. Taxation—People’s Republic of China Taxation.”

In addition, subject to the passive foreign investment company rules, the gross amount of any distribution that the Company makes to investors with respect to our ADSs or ordinary shares (including any amounts withheld to reflect PRC withholding taxes) will be taxable as a dividend, to the extent paid out of our current or accumulated earnings and profits, as determined under United States federal income tax principles. Based on the past and projected composition of our income and assets, and the valuation of our assets, including goodwill, we do not expect to be a passive foreign investment company, or a PFIC, in the current taxable year or in the foreseeable future, although there can be no assurance in this regard. See “Item 3. Key Information—D. Risk Factors—Risks Relating to Regulations of Our Business—We may become a passive foreign investment company, or PFIC, which could result in adverse U.S. tax consequences to U.S. investors” and “Item 10. Additional Information—E. Taxation—United States Federal Income Taxation—Passive Foreign Investment Company.”

Restrictions on Foreign Exchange and Our Ability to Transfer Cash Between Entities, Across Borders, and to U.S. Investors, and Restrictions and Limitations on Our Ability to Distribute Earnings from Our Businesses

We face various restrictions and limitations that impact our ability to transfer cash between our entities, across borders and to U.S. investors, and our ability to distribute earnings from our business, including our subsidiaries, to the Company and U.S. investors.

| • | We are not a Chinese operating company but a Cayman Islands holding company with operations conducted through our PRC subsidiaries. As a result, although other means are available for us to obtain financing at the Company level, the Company’s ability to fund operations not conducted by our PRC subsidiaries, pay dividends to its shareholders, or service any debt it may incur may depend upon dividends paid by our PRC subsidiaries. If any of our PRC subsidiaries incurs debt on its own in the future, the instruments governing such debt may restrict its ability to pay dividends to the Company. If any of our PRC subsidiaries is unable to receive all or the majority of the revenues from their operations, we may be unable to pay dividends on our ADSs or common shares. |

| • | Due to restrictions on foreign exchange placed on our PRC subsidiaries by the PRC government under PRC laws and regulations, to the extent cash is located in mainland China or within an entity domiciled in mainland China and may need to be used to fund our operations outside of mainland China, the funds may not be available due to such limitations unless and until related approvals and registrations are obtained. The PRC government imposes controls on the convertibility of Renminbi into foreign currencies and, in certain cases, the remittance of currency out of mainland China. The majority of our revenue is or will be received in Renminbi and shortages in foreign currencies may restrict our ability to pay dividends or other payments. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from trade-related transactions, can be made in foreign currencies without prior approval from the State Administration of Foreign Exchange, or SAFE, as long as certain procedural requirements are met. Approval from or filing with appropriate government authorities is required if Renminbi is converted into foreign currency and remitted out of mainland China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may, at its discretion, impose restrictions on access to foreign currencies for current account transactions and if this occurs in the future, we may not be able to pay dividends in foreign currencies to our shareholders or repay our loans. See “Item 3. Key Information—D. Risk Factors—Government control of foreign currency conversion may affect the value of your investment.” |

| • | Under PRC laws and regulations, each of our PRC operating subsidiaries may only pay dividends after 10% of its net profit has been set aside as reserve funds, unless such reserves have reached at least 50% of its registered capital. In addition, the profit available for distribution from our PRC operating subsidiaries is determined in accordance with generally accepted accounting principles in the PRC. This calculation may differ if it were performed in accordance with U.S. GAAP. See “Item 3. Key Information—D. Risk Factors—Our corporate structure may restrict our ability to receive dividends from, and transfer funds to, our PRC operating subsidiaries, which could restrict our ability to act in response to changing market conditions in a timely manner.” |

6

Table of Contents

| • | Due to various requirements imposed by PRC laws and regulations on loans to and direct investment in PRC entities by offshore holding companies, any loans to our PRC subsidiaries, which are foreign-invested enterprises, cannot exceed a statutory limit, and shall be filed with SAFE or its local counterparts. Furthermore, any capital contributions we make to our PRC subsidiaries shall be registered with the PRC State Administration for Market Regulation or its local counterparts, and reported to with the Ministry of Commerce or its local counterparts. This may delay or prevent us from using our offshore funds to make loans or capital contribution to our PRC subsidiaries and thus may restrict our ability to execute our business strategy, and materially and adversely affect our liquidity and our ability to fund and expand our business. See “Item 3. Key Information—D. Risk Factors—PRC regulation of loans and direct investment by offshore holding companies to PRC entities may delay or prevent us from using the proceeds of our initial public offering to make loans or additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business operations.” |

| • | If the Company is considered a PRC tax resident enterprise for tax purposes (we do not currently consider the Company to be a PRC resident enterprise), any dividends that the Company pays to its overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax. See “ Item 3. Key Information—D. Risk Factors— Risks Relating to Regulations of Our Business—Dividends payable by us to our foreign investors and gains on the sale of the ADSs may become subject to withholding taxes under the PRC tax laws.” |

Effect of Holding Foreign Companies Accountable Act and Related SEC Rules

The Holding Foreign Companies Accountable Act, or the HFCA Act, was enacted on December 18, 2020. The HFCA Act states if the SEC determines that a company has filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the Public Company Accounting Oversight Board, or PCAOB, for three consecutive years beginning in 2021, the SEC shall prohibit its shares or ADSs from being traded on a national securities exchange or in the over the counter trading market in the U.S. Our auditor, which is based in New York, is currently subject to inspection by the PCAOB at least every three years. However, our auditor’s China affiliate is located in, and organized under the laws of, the PRC.

On March 18, 2021, the SEC adopted on an interim basis rules disclosure requirements for companies with PCAOB member auditors whom the PCAOB has determined that it cannot inspect their operations within a foreign jurisdiction (“Covered Issuers”). Covered companies are required to disclose in their annual reports on Form 20-F: (i) that, during the period covered by the form, the registered public accounting firm has prepared an audit report for the issuer; (ii) the percentage of the shares of the issuer owned by governmental entities in the foreign jurisdiction in which the issuer is incorporated or otherwise organized; (iii) whether governmental entities in the applicable foreign jurisdiction with respect to that registered public accounting firm have a controlling financial interest with respect to the issuer; (iv) the name of each official of the Chinese Communist Party (“CCP”) who is a member of the board of directors of the issuer or the operating entity with respect to the issuer; and (v) whether the articles of incorporation of the issuer (or equivalent organizing document) contains any charter of the CCP, including the text of any such charter. On September 22, 2021, the PCAOB adopted rules governing its procedures for making determinations as to its inability to inspect or investigate registered firms headquartered in a particular foreign jurisdiction or which has an office in a foreign jurisdiction (a “PCAOB-Identified Firm”). Promptly after the effective date of this rule, the PCAOB would make determinations under the HFCA Act to the extent such determinations are appropriate. Thereafter, the PCAOB would consider, at least annually, whether changes in facts and circumstances support any additional determinations. The PCAOB would make additional determinations as and when appropriate, to allow the SEC on a timely basis to identify Covered Issuers pursuant to the SEC rules. The rule became effective when the SEC approved the rule on November 4, 2021.

7

Table of Contents

On December 2, 2021, the SEC finalized its rules regarding disclosure by Covered Issuers. In addition, the release discussed the procedures the SEC will follow in implementing trading prohibitions for Covered Issuers. A foreign company would have to be designated a Covered Issuer three years in a row to be subject to a trading prohibition on that basis. The trading suspension would prohibit trading of the Covered Issuer’s securities on any exchange or in the over-the-counter markets. The trading prohibition will be terminated if the Covered Issuer certifies to the SEC that the issuer has retained a registered public accounting firm that the PCAOB has inspected to the satisfaction of the SEC and files financial statements that include an audit report signed by the non-PCAOB-Identified Firm. The SEC is not required to engage in rulemaking to implement the trading prohibition provisions of the HFCA Act. Neither the Act nor the SEC’s release create an obligation for an exchange to delist the Covered Issuer, but the SEC noted that under existing listing rules of the exchanges, a trading prohibition would be grounds for delisting. On December 16, 2021, the PCAOB issued a report on its determinations that it is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong because of positions taken by PRC authorities in those jurisdictions. On August 26, 2022, the PCAOB entered into a Statement of Protocol with the China Securities Regulatory Commission and the Ministry of Finance of the PRC and, as summarized in the “Statement on Agreement Governing Inspections and Investigations of Audit Firms Based in China and Hong Kong” published on the U.S. Securities and Exchange Commission’s official website, the parties agreed to the following: (i) in accordance with the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation; (ii) the PCAOB shall have direct access to interview or take testimony from all personnel of the audit firms whose issuer engagements are being inspected or investigated; (iii) the PCAOB shall have the unfettered ability to transfer information to the SEC, in accordance with the Sarbanes-Oxley Act; and (iv) the PCAOB inspectors shall have access to complete audit work papers without any redactions, with view-only procedures for certain targeted pieces of information such as personally identifiable information. The PCAOB is required to reassess its determinations as to whether it is able to carry out inspection and investigation completely and without obstruction by the end of 2022. On December 15, 2022, the PCAOB issued a report that vacated its December 16, 2021 determination and removed mainland China and Hong Kong from the list of jurisdictions where it is unable to inspect or investigate completely registered public accounting firms. Each year, the PCAOB will determine whether it can inspect and investigate completely audit firms in mainland China and Hong Kong, among other jurisdictions. If the PCAOB determines in the future that it no longer has full access to inspect and investigate completely accounting firms in mainland China and Hong Kong and we continue to use an accounting firm headquartered in one of these jurisdictions to issue an audit report on our financial statements filed with the SEC, we would be identified as a Covered Issuer following the filing of the annual report on Form 20-F for the relevant fiscal year. There can be no assurance that we would not be identified as a Covered Issuer for any future fiscal year, and if we were so identified for two consecutive years, we would become subject to the prohibition on trading under the HFCAA. If such event were to occur, trading in our securities could in the future be prohibited under the HFCA Act, so we cannot assure you that we will be able to maintain the listing of the ADRs on Nasdaq or that you will be allowed to trade the ADRs in the United States on the “over-the-counter” markets or otherwise. Should the ADRs not be listed or tradeable in the United States, the value of the ADRs could be materially affected.

8

Table of Contents

| A. | [Reserved] |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

Summary of Risk Factors

Investing in our ADSs may expose you to a number of risks, including risks relating to our business and industry, risks relating to regulations of our business, risks relating to doing business in the PRC, risks relating to our corporate structure and risks relating to our ADSs. The following summarizes part, but not all, of these risks. Please carefully consider all of the information discussed in “Item 3. Key Information—D. Risk Factors” and elsewhere in this annual report which contains a more thorough description of risks relating to investing in us.

Risks Relating to Our Business and Industry

| • | There is no assurance that a cryptocurrency will maintain its long-term value, and volatility in the market prices of cryptocurrencies may adversely affect our business and results of operations. |

| • | The industry in which we operate is characterized by constant changes. If we fail to innovate or to provide products that meet the expectations of our customers, we may be unable to attract new customers or retain existing customers, and as a result our business and results of operations may be adversely affected. |

| • | We are subject to risks associated with legal, political or other conditions or developments regarding holding, using or mining of cryptocurrencies and related products and services, which could negatively affect our business, financial condition, and results of operations. |

| • | We derive a significant portion of our revenue from our ASIC chips. If the market for ASIC chips used in cryptocurrency mining machines ceases to exist or diminishes significantly, our business and results of operations would be materially harmed. |

| • | We generate all of our revenue from sales to customers in the PRC. Any adverse development in the regulatory environment in the PRC could have a negative impact on our business, financial condition and results of operations. |

9

Table of Contents

| • | Our ASIC chips business depends mainly on supplies from a single third-party foundry, and any failure to obtain sufficient foundry capacity from this foundry would significantly delay the shipment of our products. |

| • | Mining difficulty for any reason would negatively affect the economic returns of cryptocurrency mining activities, which in turn would decrease the demand for and/or pricing of our products. |

| • | Cryptocurrency exchanges and wallets, and to a lesser extent, the cryptocurrency network itself, may suffer from hacking and fraud risks, which may erode user confidence in cryptocurrency which would in turn decrease the demand for our ASIC chips that are used in cryptocurrency mining machines. |

| • | Cryptocurrency mining activities are energy-intensive. The availability and cost of electricity will restrict the geographic locations of mining activities, thereby restricting the geographic locations of miners and sales of our products. |

| • | Failure at tape-out or failure to achieve the expected final test yields for our ASIC chips could negatively impact our operating results. |

| • | Any failure of our products to meet the necessary quality standards could adversely affect our reputation, business and results of operation. |

| • | We may be unable to make the substantial investments in research and development that are required to remain competitive in our business. |

| • | Failure to maintain inventory levels in line with the approximate level of demand for our products could cause us to lose sales, expose us to increased inventory risks and subject us to increases in holding costs, risk of inventory obsolescence, increases in markdown allowances and write-offs, any of which could have a material adverse effect on our business, financial condition and results of operations. |

| • | The average selling prices of our products may decrease from time to time due to technological advancement and we may not be able to pass such decreases onto our suppliers, which may in turn adversely affect our profitability. |

| • | If we are unable to effectively execute our growth strategies, maintain our rapid growth trends and manage risks associated with expanding the scale of our operations, our ability to grow our business and establish our overseas market may be negatively affected. |

| • | Our limited operating history and rapid revenue growth may make it difficult for us to forecast our customer demand and our business development, or to assess the seasonality and volatility in our business. |

| • | We rely on a limited number of third parties to package and test our products. |

| • | Our prepayments to suppliers may subject us to counterparty risk associated with such suppliers and negatively affect our liquidity and cash position. |

Risks Relating to Doing Business in the PRC

| • | Changes in the political and economic policies of the Chinese government or in relations between China and the United States may materially and adversely affect our business, financial condition, results of operations and the market price of our ADSs. |

| • | The Chinese government may intervene in or influence our operations at any time, which could result in a material change in our operations and significantly and adversely impact the value of our ADSs. |

| • | Changes in U.S. and Chinese regulations may adversely impact our business, our operating results, our ability to raise capital and the market price of our ADSs. |

| • | The approval of the CSRC, CAC or other Chinese regulatory agencies may be required in connection with our offshore offerings under Chinese law. and, if required, we cannot predict whether we will be able to obtain such approval or complete such filing. |

| • | Recent negative publicity surrounding China-based companies listed in the United States may negatively impact the trading price of our ADSs. |

10

Table of Contents

| • | Changes to and uncertainties in the legal system of the PRC may have a material adverse impact on our business, financial condition and results of operations. Legal protections available to you under the legal system of the PRC may be limited. |

| • | PRC regulations relating to the establishment of offshore special purpose vehicles by PRC residents may subject our PRC-resident beneficial owners or our PRC subsidiaries to liability or penalties, limit our ability to make capital contributions into our PRC subsidiaries, limit our PRC subsidiaries’ ability to distribute profits to us, or otherwise adversely affect our financial position. |

| • | Our corporate structure may restrict our ability to receive dividends from, and transfer funds to, our PRC operating subsidiaries, which could restrict our ability to act in response to changing market conditions in a timely manner. |

| • | Dividends payable by us to our foreign investors and gains on the sale of the ADSs may become subject to withholding taxes under the PRC tax laws. |

| • | PRC regulation of loans and direct investment by offshore holding companies to PRC entities may delay or prevent us from using the proceeds of our initial public offering to make loans or additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business operations. |

| • | We may be classified as a “resident enterprise” for PRC enterprise income tax purposes, which could result in unfavorable tax consequences to us and our non-PRC shareholders. |

| • | Government control of foreign currency conversion may affect the value of your investment. |

Risks Relating to the ADSs

| • | Recent litigation and negative publicity surrounding China-based companies listed in the United States may negatively impact the trading price of our ADSs. |

| • | The trading price of the ADSs is likely to be volatile, which could result in substantial losses to investors. |

| • | If securities or industry analysts do not publish research or reports about our business, or if they adversely change their recommendations regarding the ADSs, the market price for the ADSs and trading volume could decline. |

| • | Because we do not expect to pay dividends in the foreseeable future after our initial public offering, you must rely on price appreciation of the ADSs for a return on your investment. |

| • | Our dual-class voting structure will limit your ability to influence corporate matters and could discourage others from pursuing any change of control transactions that holders of our Class A ordinary shares and ADSs may view as beneficial |

| • | The dual-class structure of our ordinary shares may adversely affect the trading market for our ADSs. |

| • | Our amended and restated memorandum and articles of association contain anti-takeover provisions that could have a material adverse effect on the rights of holders of our Class A ordinary shares and ADSs. |

Risks Relating to Our Business and Industry

There is no assurance that a cryptocurrency will maintain its long-term value, and volatility in the market prices of cryptocurrencies may adversely affect our business and results of operations.

As a relatively new product based on technologies developed in recent years, cryptocurrencies have only recently been accepted as a means of payment for goods and services by selected industries and in selected markets, and the use of cryptocurrencies by consumers to make payment remains limited. Additionally, as the value of most cryptocurrencies is not anchored by any reserve currency or precious metal, nor is it backed by any government or commercial enterprise, the long-term value of cryptocurrencies is uncertain, which may further increase the volatility in cryptocurrency prices. Banks and other established financial institutions may refuse to process funds for cryptocurrency transactions, process wire transfers to or from cryptocurrency exchanges, or maintain accounts for persons or entities transacting in cryptocurrencies.

Meanwhile, a significant portion of cryptocurrency demand is generated by speculators and investors seeking to profit from the short or long-term holding of cryptocurrencies. The prices of cryptocurrencies may also be impacted by evolving and uncertain regulatory environment and the development of blockchain technology. As a result of the foregoing, the prices of cryptocurrencies have been quite volatile during its limited history.

11

Table of Contents

Our business and financial condition highly correlate with market prices of cryptocurrencies. Our ASIC chip is the core component of the cryptocurrency mining machine. We price our ASIC chips with reference to the market price of cryptocurrencies and the expected economic return of cryptocurrency mining, among other factors. In 2020, 2021 and 2022, respectively, almost all of our revenue was generated from the sales of ASIC chips for cryptocurrency mining machines. Any wild fluctuations in the market price of cryptocurrencies may have a material adverse impact on our business, financial condition and results of operations. In addition, if there is a steep increase in the market price of cryptocurrencies, market demand for our ASIC chips is also likely to surge. In the event that our production and service capabilities cannot quickly catch up, we may lose our customers and market share. In addition, if market demand increases beyond our expectations, we may not be able to maintain an adequate inventory level of our finished goods, and may lose sales and market share to our competitors as a result.

On the other hand, if the market price of cryptocurrencies falls significantly, economic returns for mining activities as well as demand for our ASIC chips will likely drop rapidly. We may be exposed to increased inventory risks due to accumulating excessive inventory of our products or raw materials, parts and components for our products.

The industry in which we operate is characterized by constant changes. If we fail to innovate or to provide products that meet the expectations of our customers, we may be unable to attract new customers or retain existing customers, and as a result our business and results of operations may be adversely affected.

The industry in which we operate is characterized by constant changes, including rapid technological evolution, continual shifts in customer demand, frequent introductions of new products and solutions and constant emergence of new industry standards and practices. For example, algorithms used for mining a certain cryptocurrency may change from time to time, and our customers may demand ASIC chips with the latest algorithms that meet their requirements. Thus, our success will depend, in part, on our ability to respond to these changes in a cost-effective and timely manner. We need to anticipate the emergence of new technologies and assess their market acceptance. We also need to invest significant resources in research and development in order to keep our products competitive in the market.

However, research and development activities are inherently uncertain, and we might encounter practical difficulties in commercializing our research and development results, which could result in excessive research and development expenses or delays. Given the fast pace with which blockchain technologies have been and will continue to be developed, we may not be able to timely upgrade our technologies in an efficient and cost-effective manner, or at all. In addition, new developments in deep learning, IoT, computer vision, blockchain and cryptocurrency could render our products obsolete or unattractive. If we are unable to keep up with the technological developments and anticipate market trends, or if new technologies render our technologies or solutions obsolete, customers may no longer be attracted to our products. As a result, our business, results of operations and financial condition would be materially and adversely affected.

As our current ASIC chips are mainly designed for cryptocurrency mining, any limitation on the usage and adaptation of cryptocurrency and any actual or perceived adverse development in the cryptocurrency market, which is rapidly and continuously evolving, can adversely affect our results of operations. As there is no wide consensus with respect to the value and application of cryptocurrency, any future development may continue to affect the price of cryptocurrency and as a result affect the demand for our current ASIC chips. In addition, any event or rumor that generates negative publicity for the cryptocurrency industry and market, such as allegations that cryptocurrency is used for money laundering or other illicit activities, could result in harm to our reputation, which in turn may negatively affect our results of operations.

Decentralization, or the lack of control by a central authority, is a key reason that cryptocurrencies have attracted many committed users. However, the decentralized nature of cryptocurrency is subject to growing discussion and suspicion. Individuals, companies or groups, as well as cryptocurrency exchanges that own vast amounts of cryptocurrencies, can affect the market price of cryptocurrency. Furthermore, mining equipment production and mining pool locations are becoming centralized. The suspicion about the decentralized nature of cryptocurrency may cause our customers to lose confidence in the prospects of the cryptocurrency industry. This in turn could adversely affect the market demand for our ASIC chips and our business.

We are subject to risks associated with legal, political or other conditions or developments regarding holding, using or mining of cryptocurrencies and related products and services, which could negatively affect our business, financial condition, and results of operations.

End users of our products are based across the world. As such, changes in government policies, taxes, general economic and fiscal conditions, as well as political, diplomatic or social events, expose us to financial and business risks. In particular, changes in domestic or overseas policies and laws regarding holding, using and/or mining of cryptocurrencies and related products and services could result in an adverse effect on our business operations and results of operations. Moreover, if any domestic or international jurisdiction where we operate or sell our ASIC chips prohibits or restricts cryptocurrency mining activities, we may face legal and other liabilities and may experience a material loss of revenue.

12

Table of Contents

There are significant uncertainties regarding future regulations pertaining to the holding, using or mining of cryptocurrencies and related products and services, which may adversely affect our results of operations. While cryptocurrency has gradually gained more market acceptance and attention, it is anonymous and may be used for black market transactions, money laundering, tax evasion, terrorism or other illegal activities. As a result, governments may seek to regulate, restrict, control or ban the mining, use and holding of cryptocurrencies and related products and services. Our existing policies and procedures for the detection and prevention of money laundering and terrorism-funding activities through our business activities have only been adopted in recent years and may not completely eliminate instances in which we or our products may be used by other parties to engage in money laundering and other illegal or improper activities. We cannot assure you that there will not be a failure in detecting money laundering or other illegal or improper activities which may adversely affect our reputation, business, financial condition and results of operations.

With advances in technology, cryptocurrencies are likely to undergo significant changes in the future. It remains uncertain whether cryptocurrency will be able to cope with, or benefit from, those changes. In addition, as cryptocurrency mining employs sophisticated and high computing power devices that need to consume a lot of electricity to operate, future developments in the regulation of energy consumption, including possible restrictions on energy usage in the jurisdictions where we sell our products, may also affect our business operations and the demand for our current ASIC chips. There has been public backlash surrounding the environmental impact of cryptocurrency mining, particularly the large consumption of electricity, and governments of various jurisdictions have responded. For example, in the United States, certain local governments of the state of Washington have discussed measures to address environmental impact of cryptocurrency-related operations, such as the high electricity consumption of cryptocurrency mining activities. Pursuant to the Announcement on Prevention of Risks from Offering and Financing of Cryptocurrencies promulgated by seven PRC governmental authorities including the PBOC on September 4, 2017, and Guarding against the Speculative Risks of Cryptocurrency Trading promulgated by the National Internet Finance Association of China, the China Banking Association; and the Payment & Clearing Association of China on May 18, 2021, illegal activities in offering and financing of cryptocurrencies, including initial coin offerings (ICOs), are forbidden in the PRC because such activities may be considered to constitute illegal offering of securities or illegal fundraising. Furthermore, financial institutions and payment institutions shall not engage in businesses related to cryptocurrency offering or financing transactions. Pursuant to the Circular of the Regulating Cryptocurrency Mining Activities promulgated by eleven PRC governmental authorities including the PBOC on September 3, 2021, which aims to dispose of the “hidden risks” in cryptocurrency mining as it pursues China’s carbon-neutrality goals, and cryptocurrency mining is to be classified as a phased-out industry. This circular does not outlaw cryptocurrency mining completely, rather it orders local authorities to clamp down on illegal mining activities with plans to gradually phase out the industry. Investing in and constructing new mining projects will not be allowed and the existing mining projects will be given time to exit, and the entire industrial chain of the upstream and downstream of cryptocurrency mining activities will be tighten regulated. On September 15, 2021, ten PRC governmental authorities including the People’s Bank of China, or the PBOC, issued the Notice on Further Preventing and Disposing of Risks in Cryptocurrency Trading and Speculation. This notice reiterates that cryptocurrencies do not have the same legal status as legal currencies, and emphasizes that cryptocurrency-related businesses are illegal financing activities such as conducting exchanges between legal currencies and cryptocurrencies, exchanges among different cryptocurrencies, trading cryptocurrencies as a central counterparty, matching and pricing services for cryptocurrency transactions, token issuance and financing, and cryptocurrencies derivatives transactions. Cryptocurrency exchanges providing services to domestic residents are also illegal financial activities, and the relevant domestic staff and subjects providing marketing and promotion, payment and settlement, and technical support services for them will be investigated for knowingly participating in the cryptocurrency industry. On March 12, 2022, the National Development and Reform Commission of the PRC (NDRC) published the Market Access Negative List (2022 Edition) , which lists the virtual currency mining activities as the “backward production processes and equipment” under the eliminated item in the Catalogue for Guiding Industrial Restructuring. According to such list, market entities are prohibited from investing in eliminated items. The above regulations and policies may result in no customers in the PRC buying our products.

We derive a significant portion of our revenue from our ASIC chips. If the market for ASIC chips used in cryptocurrency mining machines ceases to exist or diminishes significantly, our business and results of operations would be materially harmed.

Historically, we derived a significant portion of our revenue from the sales of our proprietary ASIC chips, and this is expected to continue in the foreseeable future. In 2020, 2021 and 2022, sales of our ASIC chips accounted for 89.0%, 88.6% and 92.2% of our revenue, respectively. If the market for ASIC chips used in cryptocurrency mining machines ceases to exist or diminishes significantly, we would experience a significant loss of sales, cancelation of orders, or loss of customers for our ASIC chips. If we cannot maintain the scale and profitability of our ASIC chips, our business, results of operations and ability to continue to grow will suffer. Furthermore, excess inventories, inventory markdowns, brand image deterioration and margin squeeze caused by declining economic returns for miners or pricing competition for our ASIC chips could all have a material and adverse impact on our business, financial condition and results of operations.

13

Table of Contents

We generate all of our revenue from sales to customers in the PRC. Any adverse development in the regulatory environment in the PRC could have a negative impact on our business, financial condition and results of operations.

We sell all of our ASIC chips to distributors in the PRC which in turn sell our products to cryptocurrency miners. We generate all of our revenue from customers in the PRC. If there is any adverse development in the regulatory environment concerning cryptocurrency mining in the PRC, our business, financial condition and results of operations will be materially and adversely affected. For example, on September 15, 2021, ten PRC governmental authorities including the PBOC issued the Notice on Further Preventing and Disposing of Risks in Cryptocurrency Trading and Speculation. This notice reiterates that cryptocurrencies do not have the same legal status as legal currencies, and emphasizes that cryptocurrency-related businesses are illegal financing activities such as conducting exchanges between legal currencies and cryptocurrencies, exchanges among different cryptocurrencies, trading cryptocurrencies as a central counterparty, matching and pricing services for cryptocurrency transactions, token issuance and financing, and cryptocurrencies derivatives transactions. There is no assurance that we will be able to effectively respond to any changes in PRC industrial policies as well as their implementation and interpretation. To the extent we are not able to generate sufficient sales from overseas markets to offset any decrease in demand from our PRC customers, our business and results of operations will be negatively impacted. In particular, if the PRC government completely bans the mining, even the upstream and downstream industry of the mining, possession and use of cryptocurrency, we will not be able to sell our products in the PRC, and we may not be able to generate sufficient sales overseas to make up for such loss of business in the PRC.

In addition, PRC government authorities have broad powers to adopt regulations and other requirements affecting or restricting our operations, including tax policies. Moreover, these relevant regulatory authorities possess significant powers to enforce applicable regulatory requirements in the event of our non-compliance, including the imposition of fines, sanctions or the revocation of licenses or permits to operate our business. We cannot assure you that we will not face administrative fines or penalties concerning our operations or our subsidiaries, which could have a material adverse impact on our results of operation.

Our ASIC chips business depends mainly on supplies from a single third-party foundry, and any failure to obtain sufficient foundry capacity from this foundry would significantly delay the shipment of our products.

As a fabless IC design company, we do not own any IC fabrication facilities. A leading semiconductor foundry has been our major third-party foundry partner for our ASIC chips business (the “Foundry Partner”). In 2020, 2021 and 2022, the value of the ICs we purchased from the Foundry Partner accounted for 84.0%, 45.3% and 49.6%, respectively, of our total procurement for the respective periods. It is important for us to have a reliable relationship with the Foundry Partner and other future foundry service providers to ensure adequate product supply to respond to customer demand.

We cannot guarantee that the Foundry Partner will be able to meet our manufacturing requirements. The ability of the Foundry Partner to provide us with foundry services is limited by its technology migration, available capacity and existing obligations. If the Foundry Partner fails to succeed in its technology migration, it will not be able to deliver to us qualified ICs, which will significantly affect our technological advancement and shipment of ASIC chips. This could in turn result in lost sales and have a material adverse effect on our relationships with our customers and on our business and financial condition. In addition, we do not have a guaranteed level of production capacity from the Foundry Partner. We do not have long-term contracts with the Foundry Partner, and we source our supplies on a purchase order basis and prepay the purchase amount. As a result, we depend on the Foundry Partner to allocate to us a portion of its manufacturing capacity sufficient to meet our needs, to produce products of acceptable quality and at acceptable final test yields and to deliver those products to us on a timely basis and at acceptable prices. If the Foundry Partner raises its prices or is unable or unwilling to meet our required capacity for any reason, such as shortages or delays in the shipment of semiconductor equipment or raw materials required to manufacture our ICs, or if our business relationships with the Foundry Partner deteriorate, we may not be able to obtain the required capacity and would have to seek alternative foundries, which may not be available on commercially reasonable terms, or at all. Moreover, it is possible that other customers of the Foundry Partner that are larger and/or better financed than we are, or that have long-term contracts with it, may receive preferential treatment in terms of capacity allocation or pricing. In addition, if we do not accurately forecast our capacity needs, the Foundry Partner may not have available capacity to meet our immediate needs or we may be required to pay higher costs to fulfill those needs, either of which could materially and adversely affect our business, operating results or financial condition.

In particular, the production of our ASIC chips may require advanced IC fabrication technologies, and foundries other than the Foundry Partner might not have sufficient production capacity for such technologies, if at all, to meet our requirements. This may expose us to risks associated with engaging new foundries. For example, using foundries with which we have not established relationships could expose us to potentially unfavorable pricing, unsatisfactory quality or insufficient capacity allocation.

Other risks associated with our dependence on a single third-party foundry include limited control over delivery schedules and quality assurance, lack of capacity in periods of excess demand, unauthorized use of our intellectual property and limited ability to manage inventory and parts. In particular, although we have entered into confidentiality agreements with our Foundry Partner for the protection of our intellectual property, it may not protect our intellectual property with the same degree of care as we use to protect our intellectual property. See “—If we fail to adequately protect our intellectual property rights, our ability to compete effectively or to defend ourselves from litigation could be impaired, which could reduce our total revenue and increase our costs.” If we fail to properly manage any of these risks, our business and results of operations may be materially and adversely affected.

14

Table of Contents

Moreover, if the Foundry Partner suffers any damage to its facilities, suspends manufacturing operations, loses benefits under material agreements, experiences power outages or computer virus attacks, lacks sufficient capacity to manufacture our products, encounters financial difficulties, is unable to secure necessary raw materials from its suppliers or suffers any other disruption or reduction in efficiency, we may encounter supply delays or disruptions.

Mining difficulty for any reason would negatively affect the economic returns of cryptocurrency mining activities, which in turn would decrease the demand for and/or pricing of our products.

The difficulty of cryptocurrency mining, or the amount of computational resources required for a set amount of reward for recording a new block, directly affects the expected economic returns for cryptocurrency miners, which in turn affects the demand for our ASIC chips. Cryptocurrency mining difficulty is a measure of how much computing power is required to record a new block and it is affected by the total amount of computing power in the cryptocurrency network. The cryptocurrency algorithm is designed so that one block is generated within a certain time period, no matter how much computing power is in the network. Thus, as more computing power joins the network, and assuming the rate of block creation does not change, the amount of computing power required to generate each block increases and hence the mining difficulty also increases. In other words, based on the current design of the cryptocurrency network, cryptocurrency mining difficulty would increase together with the total computing power available in the cryptocurrency network, which is in turn affected by the number of cryptocurrency mining machines in operation. As a result, strong growth in sales of our ASIC chips can contribute to further growth in the total computing power in the network, thereby driving up the difficulty of cryptocurrency mining and resulting in downward pressure on the expected economic return of cryptocurrency mining and the demand for, and pricing of, our products.

Cryptocurrency exchanges and wallets, and to a lesser extent, the cryptocurrency network itself, may suffer from hacking and fraud risks, which may erode user confidence in cryptocurrency which would in turn decrease the demand for our ASIC chips that are used in cryptocurrency mining machines.

Cryptocurrency transactions are entirely digital and, as with any virtual system, are at risk from hackers, malware and operational glitches. Hackers can target cryptocurrency exchanges and cryptocurrency transactions so as to gain access to thousands of accounts and digital wallets where cryptocurrencies are stored. Cryptocurrency transactions and accounts are not insured by any type of government program and all cryptocurrency transactions are permanent because there is no third party or payment processor. Cryptocurrency has suffered from hacking and cyber-theft as such incidents have been reported by several cryptocurrency exchanges and miners, highlighting concerns about the security of cryptocurrency and therefore affecting its demand and price. Also, the price and exchange of cryptocurrency may be affected due to fraud risk. While cryptocurrency uses private key encryption to verify owners and register transactions, fraudsters and scammers may attempt to sell false cryptocurrencies. All of the above may adversely affect the operation of the cryptocurrency network which would erode user confidence in cryptocurrency, and which would negatively affect demand for our products.

Cryptocurrency mining activities are energy-intensive. The availability and cost of electricity will restrict the geographic locations of mining activities, thereby restricting the geographic locations of miners and sales of our products.

Cryptocurrency mining activities are inherently energy-intensive and electricity costs account for a significant portion of the overall mining costs. The availability and cost of electricity will restrict the geographic locations of mining activities. Any shortage of electricity supply or increase in electricity cost in a jurisdiction may negatively impact the viability and the expected economic return for cryptocurrency mining activities in that jurisdiction, which may in turn decrease the sales of our ASIC chips in that jurisdiction.

In addition, the significant consumption of electricity may have a negative environmental impact, including contribution to climate change, which may give rise to public opinion against allowing the use of electricity for cryptocurrency mining activities or government measures restricting or prohibiting the use of electricity for cryptocurrency mining activities. Any such development in the jurisdictions where we sell our ASIC chips that are used in cryptocurrency mining machines could have a material and adverse effect on our business, financial condition and results of operations.

Failure at tape-out or failure to achieve the expected final test yields for our ASIC chips could negatively impact our operating results.

The tape-out process is a critical milestone in our business. A successful tape-out means all the stages in the design and verification process of our ASIC chips have been completed, and the product is ready to be sent for manufacturing. A tape-out will be either a success or a failure, and in the latter case design modifications will be needed. The tape-out process is very costly, and repeated failures can significantly increase our costs, lengthen our product development period and delay our product launch. While we have consistently achieved successful initial tape-outs in the initial batch historically, we cannot assure you that we will be able to continue to have a high tape-out success rate in the future.

Once tape-out is successful, the ASIC design is sent for manufacturing, and the final test yield is a measurement of the production success rate. The final test yield is a function of both of product design, which is developed by us, and process technology, which typically belongs to a third-party foundry, such as the Foundry Partner in our case. While we have historically achieved high final test yields, such as 99% between 2020 and 2022, we cannot assure you that we will be able to maintain such high final test yields in the future. Low final test yields can result from either a product design deficiency or a process technology failure or a combination of both. As such, we may not be able to identify problems causing low final test yields until our product designs go to the manufacturing stage, which may substantially increase our per unit costs and delay the launch of new products.

15

Table of Contents

For example, if the Foundry Partner experiences manufacturing inefficiencies or encounters disruptions, errors or difficulties during production, we may fail to achieve acceptable final test yields or experience product delivery delays. We cannot be certain that the Foundry Partner will be able to develop, obtain or successfully implement process technologies needed to manufacture future generations of our products on a timely basis. Moreover, during the periods in which foundries are implementing new process technologies, their manufacturing facilities may not be fully productive. A substantial delay in the technology transitions to smaller geometry process technologies could have a material and adverse effect on us, particularly if our competitors transition to such technologies before us.

In addition, resolution of yield problems requires cooperation among us, the Foundry Partner and package and test partners. We cannot assure you that the cooperation will be successful and that any yield problems can be fixed.

Any failure of our products to meet the necessary quality standards could adversely affect our reputation, business and results of operation.

The quality of our products is critical to the success of our business and depends significantly on the effectiveness of our and of our manufacturing service providers’ quality control systems. In our efforts to quickly meet new market trends and demand and to adopt new technologies, our products may not have adequate time to go through our normal rigorous testing procedures and final inspection, which could result in instances where our products cannot reach the required performance standard, or our products are found to be defective. These instances could result in our customers suffering losses. Defects detected before product delivery to our customers may result in additional costs for remediation and rework. Defects detected after the delivery and installation of our products may result in our incurring further costs relating to inspection, installation, remediation or product return, which may result in damages to our reputation, loss of customers, government fines and disputes and/or litigation.

In addition, we outsource a portion of our product manufacturing process to certain production partners, and in those instances we require these production partners to purchase parts and components from other third-party suppliers. Although we carry out quality inspections for the manufacturing process and the parts and components purchased by our production partners, we cannot assure you that we will always be able to detect defects in the manufacturing process or the parts and components purchased. Any defect in our third party manufacturing process or parts and components purchased by them may lead to defects in our finished products, which may in turn increase our costs as well as damage our reputation and market share. We may not be able to procure contractual or other indemnities from the suppliers of the defective parts and components adequately, or at all. We may be subject to product liability claims and litigation for compensation which could result in substantial and unexpected expenditures and could materially and adversely affect our cash flow and operating results.

We may be unable to make the substantial investments in research and development that are required to remain competitive in our business.

Advances in cryptocurrency mining technology and the semiconductor industry have led to increased demand for ICs of higher speed and power efficiency for solving computational problems of increasing complexity. In 2020, 2021 and 2022, we incurred research and development expenses of RMB22.5 million, RMB53.2 million and RMB48.4 million (US$7.0 million), respectively. We are committed to investing in new product development in order to stay competitive in our markets. We are driven by market demand, and we intend to continue to broaden and enhance our product portfolio in order to deliver the most effective solutions to our customers. Nevertheless, if we are unable to generate enough revenue or raise enough capital to make adequate research and development investments going forward, our product development and relevant research and development initiatives may be restricted or delayed, or we may not be able to keep pace with the latest market trends and satisfy our customers’ needs, which could materially and adversely affect our results of operations. Furthermore, our research and development expenditures may not yield the expected results that enable us to roll out new products, which in turn will harm our prospects and results of operations.

Failure to maintain inventory levels in line with the approximate level of demand for our products could cause us to lose sales, expose us to increased inventory risks and subject us to increases in holding costs, risk of inventory obsolescence, increases in markdown allowances and write-offs, any of which could have a material adverse effect on our business, financial condition and results of operations.

To operate our business successfully and meet our customers’ demands and expectations, we must maintain a certain level of finished goods inventory to ensure immediate delivery when required. However, forecasts are inherently uncertain. If our forecasted demand is lower than actual demand, we may not be able to maintain an adequate inventory level of our finished goods or produce our products in a timely manner, and we may lose sales and market share to our competitors. On the other hand, we may also be exposed to increased inventory risks due to accumulated excess inventory of our products or raw materials, parts and components for our products. Excess inventory levels may lead to increases in inventory holding costs, risks of inventory obsolescence and provisions for write-downs. The carrying value of our inventories were RMB9.5 million, RMB66.8 million and RMB77.8 million (US$11.3 million) as of December 31, 2020, 2021 and 2022, respectively.

16

Table of Contents

The average selling prices of our products may decrease from time to time due to technological advancement and we may not be able to pass such decreases onto our suppliers, which may in turn adversely affect our profitability.